tax shield formula dcf

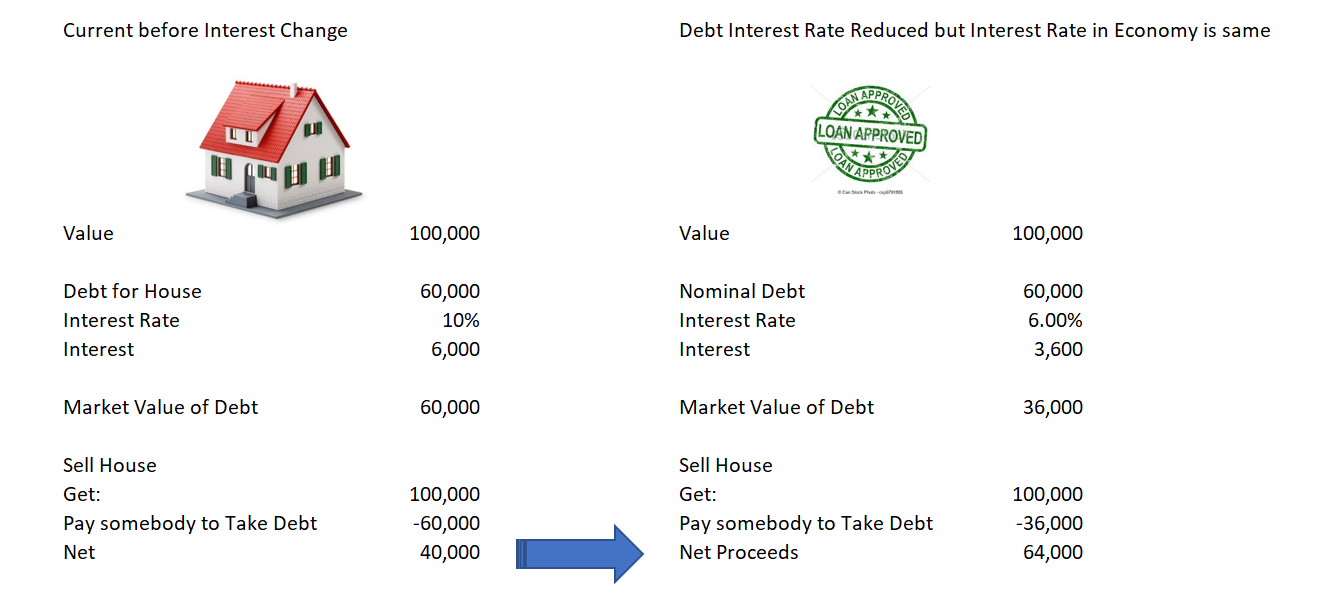

Re cost of. The cost of debt is the marginal cost of debt after giving effect to the tax shield provided by debt financing K d Outstanding Debt Marginal Interest Rate.

Wacc And Apv Dcf Valuation Methods Finance Division

The formula for calculating the interest tax shield is as follows.

. Interest Tax Shield Formula. Now in the second step we have to calculate the cost incurred on working capital. Its 50000 debt load has an interest tax shield of 15000 or 50000 30 7 7.

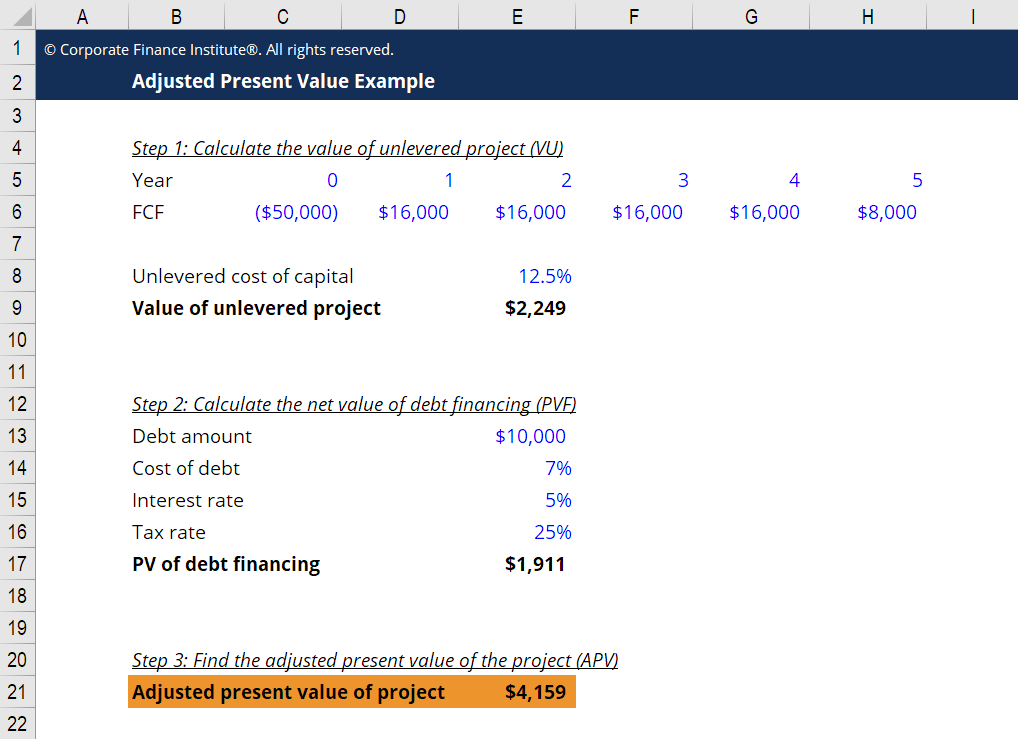

Thus the adjusted present value is 115000 or 100000 15000. Interest Tax Shield. And stand for debt and equity of the firm and are the required return rates for debt and equity is the marginal.

A tax shield is the deliberate use of taxable expenses to offset taxable income. The formula includes that comes from tax shield savings. For instance if the tax rate is 210 and the.

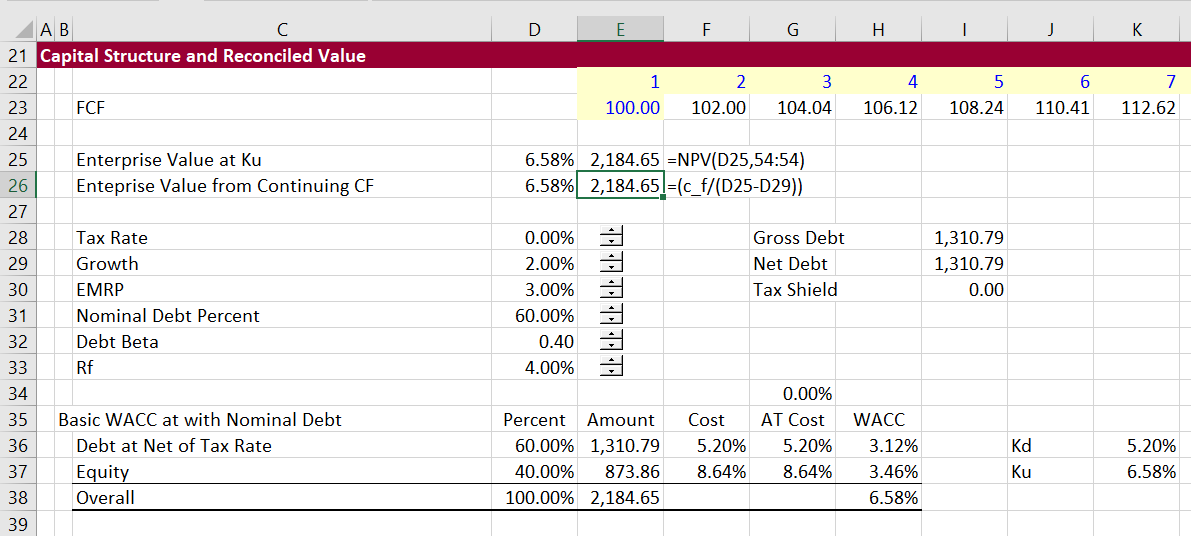

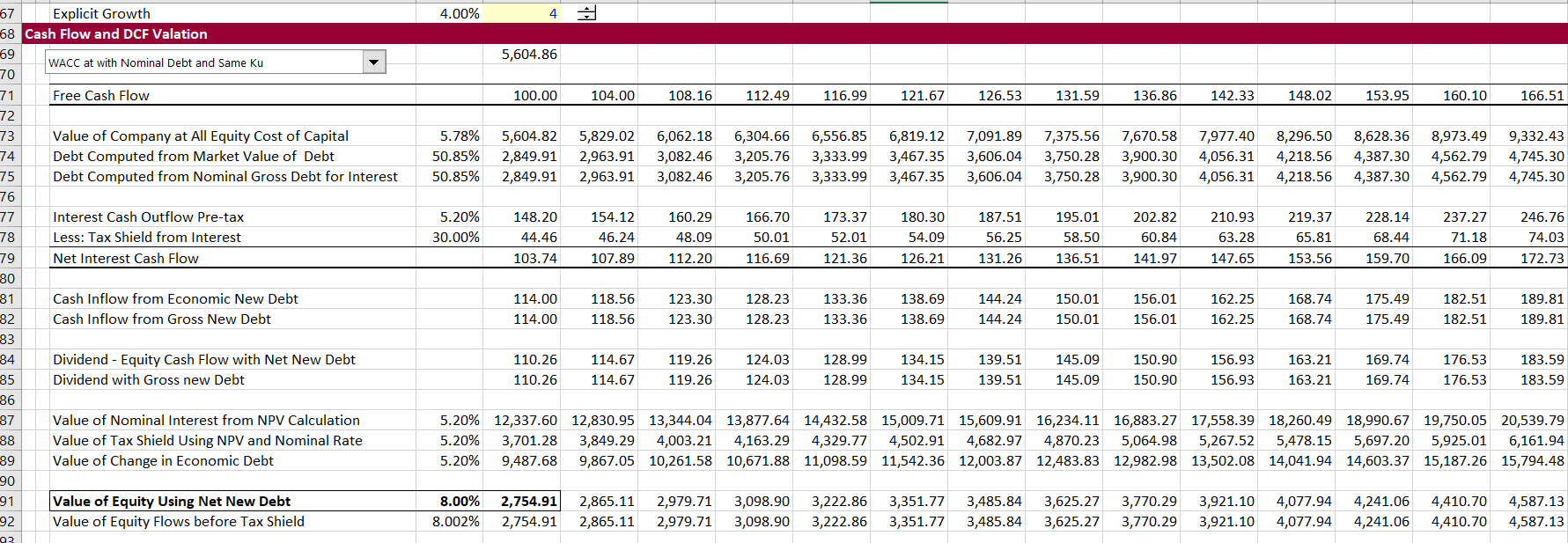

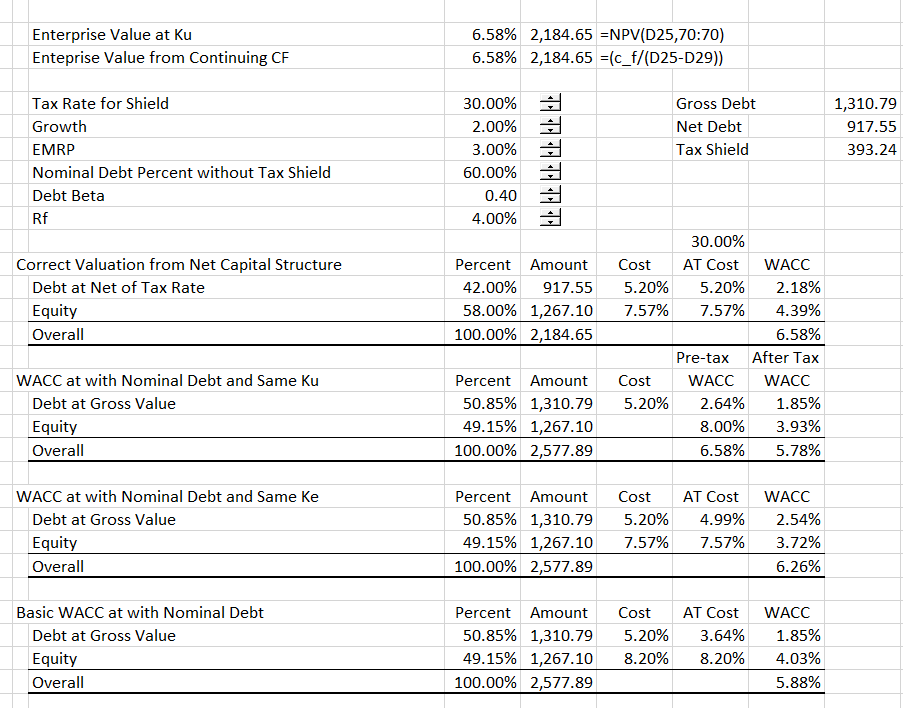

Calculate WACC Weighted Average Cost of Capital Terminal value DCF. The standard WACC approach. Concerning DCF there are three widely used methods to calculate the present value of a company.

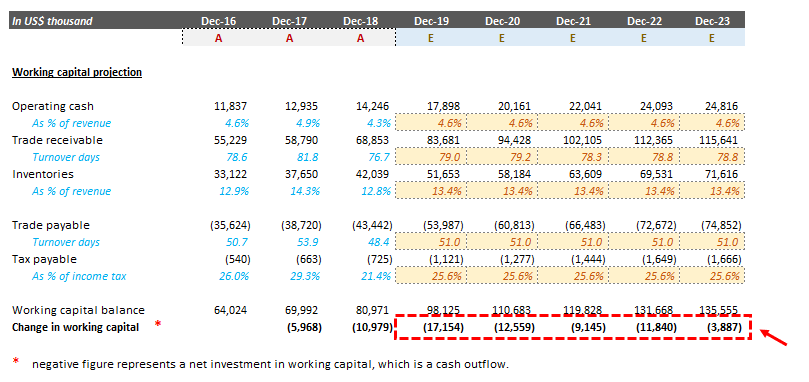

FCFFa EBIT 1-tax rate Non-Cash Charges Depreciation - Working Capital investments - Fixed capital investments Or rewriting in a short way using abbreviations. Is the levered DCF formula to calculate FCF the following one. The DCF valuation of the business is simply equal to the sum of the discounted projected Free Cash Flow amounts plus the discounted Terminal Value amount.

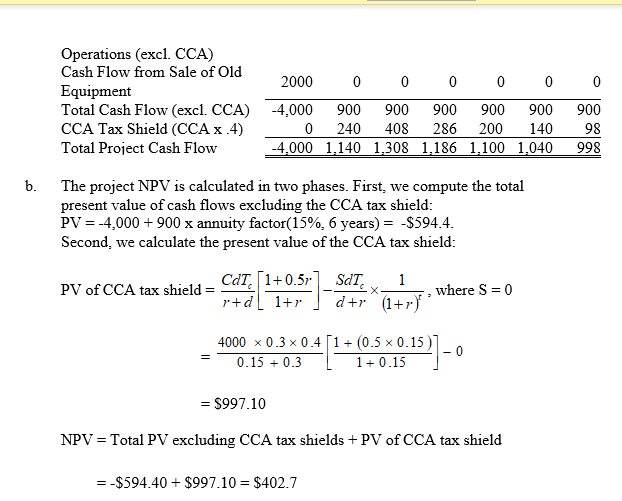

There is no exact answer for. Interest Tax Shield Interest Expense Tax Rate. Depreciation Tax Shield Formula Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage.

FCF EBIT 1-T DA - CAPEX - Change in working capital - Principal repayment - After tax interests New loans. Formula and Excel Calculator. The flows to equity method.

Proof Of Valuation Using Ku Or Wacc Without Interest Tax Shield Edward Bodmer Project And Corporate Finance

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shields Financial Expenses And Losses Carried Forward

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Unlevered Free Cash Flow Definition Examples Formula

Adjusted Present Value Apv Definition Explanation Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Solved I Am Having Difficulty In Understanding How To Chegg Com

Discounted Cash Flow Analysis Street Of Walls

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Discounted Cash Flow Analysis Street Of Walls

Tax Shield Calculator Efinancemanagement

Semih Yildirim Adms Chapter 8 Using Discounted Cash Flow Analysis Chapter Outline Discount Cash Flows Not Profits Discount Incremental Ppt Download